In the dynamic landscape of entrepreneurship, where efficiency and financial management are paramount, credit card apps have emerged as indispensable tools for small business owners. These applications offer a convenient and organized way to track expenses, manage cash flow, and optimize financial decisions, empowering entrepreneurs to make informed choices that drive growth and success. In this article, we will explore a range of credit card apps tailored to meet the unique needs of entrepreneurs, highlighting their features and benefits that streamline operations and enhance fiscal control for small businesses.

Points highlighting the significance of credit card apps for entrepreneurs as small business solutions

1. Expense Tracking and Categorization

Credit card apps offer entrepreneurs a streamlined way to track and categorize business expenses in real time. This feature reduces manual effort, ensures accuracy, and provides a clear overview of where funds are being allocated, simplifying tax preparation and financial reporting.

2. Real-Time Monitoring

These apps provide instant updates on transactions, enabling entrepreneurs to monitor spending patterns and cash flow in real time. This timely information empowers them to identify potential issues, make informed decisions, and adjust spending strategies as needed.

3. Budget Management

Credit card apps often come with budgeting tools that allow entrepreneurs to set spending limits for different categories. These tools send alerts when nearing predefined thresholds, preventing overspending and promoting responsible financial management.

4. Expense Reconciliation

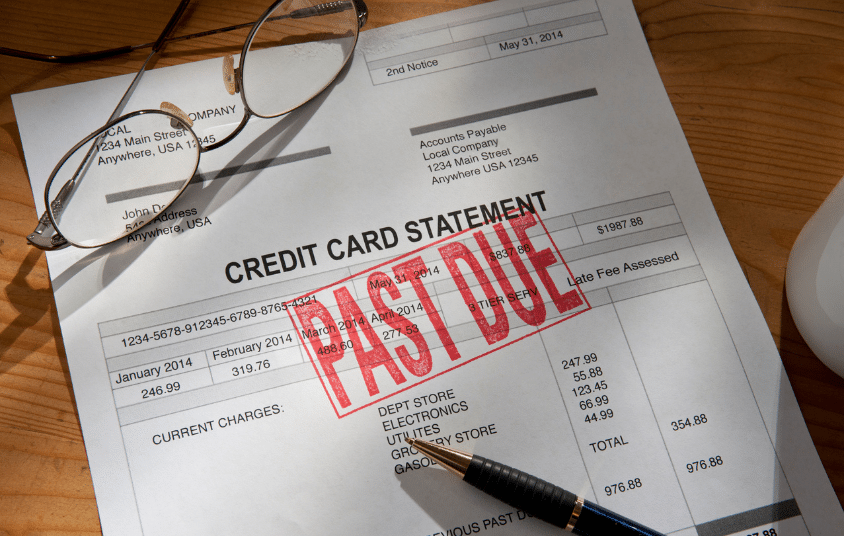

Entrepreneurs can effortlessly reconcile their credit card statements with digital records within the app. This eliminates the need for manual cross-referencing, reduces the chances of errors, and ensures accuracy in financial records.

5. Financial Insights

Many credit card apps offer data-driven insights into spending patterns and trends. Entrepreneurs can leverage these insights to identify cost-saving opportunities, discover areas for efficiency improvement, and optimize their business strategies based on historical data.

6. Integration with Accounting Software

Some credit card apps seamlessly integrate with popular accounting software, allowing for the automatic synchronization of financial data. This integration simplifies bookkeeping tasks, minimizes duplicate data entry, and enhances overall financial accuracy.

7. Security and Fraud Protection

Credit card apps typically employ robust security measures to safeguard sensitive financial information. They often provide alerts for suspicious transactions, adding an extra layer of protection against fraudulent activities that could adversely affect the business.

Also Read: Tips for Managing Your Credit Card Wisely

Bottom line

Incorporating advanced credit card applications empowers entrepreneurs with comprehensive financial management tools, transcending basic tracking to offer real-time monitoring, expense categorization, and insightful analytics. By leveraging these features, businesses can optimize cash flow, make informed decisions, and navigate economic shifts adeptly. This proactive approach not only streamlines tasks but also fosters strategic resource allocation, propelling growth and agility in competitive markets. As indispensable allies for small business success, credit card apps ultimately enable enterprises to flourish, adapt, and secure their positions in today’s dynamic business landscape.