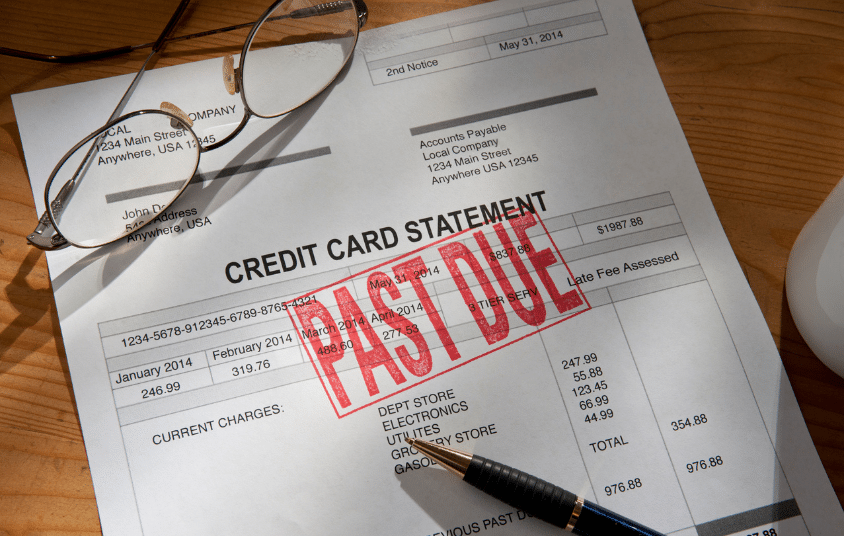

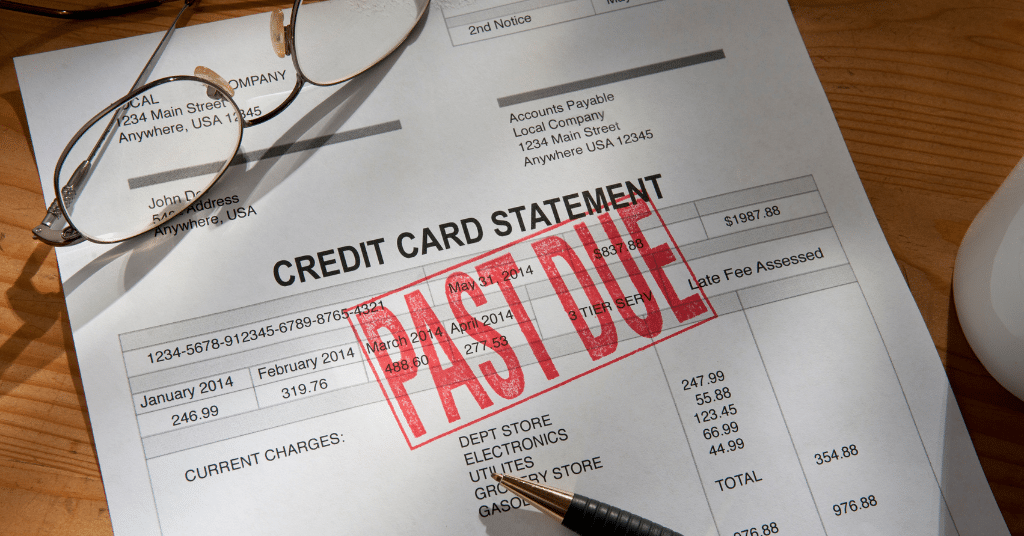

Credit cards have become an integral part of our daily lives, offering convenience and financial flexibility. However, understanding the credit card statement, particularly the due amount, can sometimes be confusing and overwhelming. It is essential to comprehend the factors that contribute to the due amount to effectively manage your finances and avoid unnecessary fees and penalties. In this article, we will break down the concept of the credit card statement due amount and provide key points to help you navigate this aspect of credit card management.

Points to Understand:

1. Statement Period

The credit card statement displays transactions and balances for a specific period, typically a month. The due amount refers to the total outstanding balance that needs to be paid by the payment due date mentioned on the statement. It includes the sum of all purchases, cash advances, balance transfers, fees, and interest charges incurred during that period.

2. Minimum Payment

Every credit card statement specifies a minimum payment amount, which is the minimum you must pay to keep your account in good standing. It is usually a small percentage of the total outstanding balance, typically ranging from 1% to 3%. While paying the minimum amount helps you avoid late fees and penalties, it is crucial to remember that carrying forward a balance incurs interest charges.

3. Total Outstanding Balance

The total outstanding balance is the cumulative amount you owe on your credit card, including both the previous balance carried forward from the previous statement and any new transactions made during the current statement period. It is the actual amount that you should strive to pay in full to avoid accumulating interest charges.

4. Grace Period

Credit cards often offer a grace period, typically ranging from 21 to 25 days, during which you can pay your outstanding balance in full without incurring any interest charges. It is important to note that the grace period is applicable only if you have paid your previous statement balance in full by the due date. If you carry forward a balance, interest charges will apply from the date of each transaction.

5. Interest Charges

If you do not pay the total outstanding balance by the due date or choose to pay only the minimum amount, the remaining balance will incur interest charges. These charges are calculated based on the annual percentage rate (APR) associated with your credit card and are typically higher than other forms of credit, such as personal loans or mortgages. It is advisable to pay your credit card balance in full each month to avoid accruing unnecessary interest charges.

Also Read: Elevate Your Lifestyle with ICICI Bank Emeralde Credit Card

Bottom Line

Understanding the credit card statement due amount is crucial for managing your finances effectively and avoiding costly penalties. By comprehending the statement period, minimum payment, total outstanding balance, grace period, and interest charges, you can make informed decisions and maintain a healthy credit card balance.

Remember to pay your credit card balance in full whenever possible to avoid interest charges and benefit from the grace period. If you are unable to pay the full amount, strive to pay more than the minimum payment to reduce your outstanding balance quicker and minimize interest expenses.

By staying aware of your credit card usage and payment responsibilities, you can maintain a good credit score, enjoy the benefits of credit card ownership, and keep your financial health intact.

In conclusion, being aware of the various elements that contribute to your credit card statement due amount empowers you to make informed financial decisions. Responsible credit card usage, timely payments, and a clear understanding of the statement will help you stay on top of your finances and avoid unnecessary debt.