In today’s world, where fuel prices seem to fluctuate unpredictably, finding ways to save on petrol expenses can make a significant difference in your budget. A premier petrol points credit card offers a solution, allowing you to earn rewards, cashback, or discounts every time you fill up your tank. In this comprehensive guide, we’ll delve into the benefits of owning a premier petrol points credit card and how you can leverage it to maximize your fuel savings.

Understanding the Premier Petrol Points Credit Card

A premier petrol points credit card is specifically designed to reward cardholders for their fuel purchases. Here’s what you need to know about this type of credit card:

How It Works:

When you use a premier petrol points credit card to pay for fuel at participating petrol stations, you earn points or cashback based on your spending. These rewards can then be redeemed for future fuel purchases or other rewards offered by the credit card issuer.

Benefits and Features:

Premier petrol points credit cards often come with a range of features and benefits tailored to fuel buyers. These may include:

- Accelerated points earning on fuel spends

- Fuel surcharge waivers or discounts

- Bonus points or cashback for initial fuel purchases

- Additional perks such as roadside assistance or travel insurance

Redemption Options:

Depending on the credit card issuer, you may have various options for redeeming your petrol points or cashback rewards. Common redemption options include:

- Redeeming points for fuel vouchers or statement credits

- Converting points into airline miles or hotel loyalty points

- Using points to shop for merchandise or gift cards

Making the Most of Your Premier Petrol Points Credit Card

To maximize your fuel savings with a premier petrol points credit card, consider the following tips:

Choose the Right Card:

Compare different petrol points credit cards available in the market and choose one that offers the best rewards rate, redemption options, and additional benefits aligned with your spending habits and lifestyle.

Optimize Your Spending:

Use your credit card for all your fuel purchases to earn maximum points or cashback. Additionally, look for opportunities to earn bonus points through promotional offers or partner merchants.

Redeem Wisely:

Monitor your points balance regularly and redeem your rewards strategically. Choose redemption options that offer the most value for your points, whether it’s fuel vouchers, travel rewards, or merchandise.

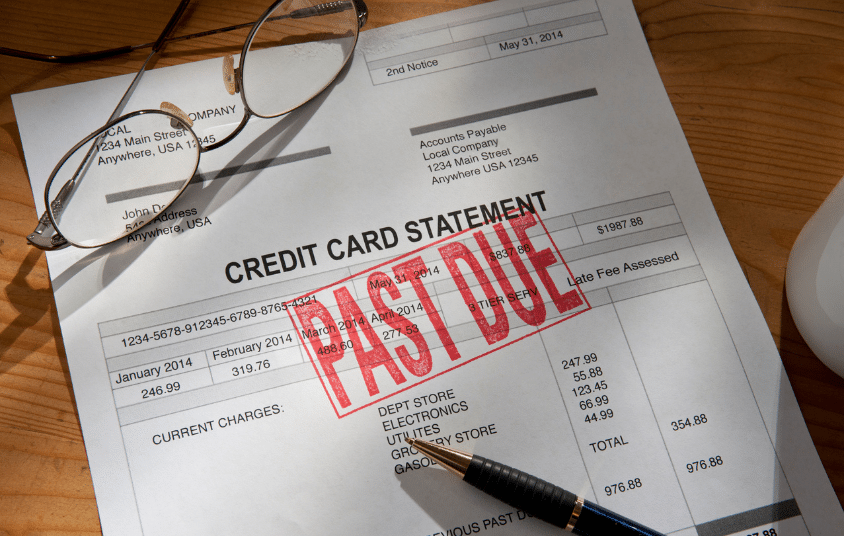

Pay Attention to Terms and Conditions:

Familiarize yourself with the terms and conditions of your credit card, including any minimum spend requirements, expiry dates for points, and limitations on earning rewards.

Also Read: AU Bank RuPay Credit Card: A Gateway to Exclusive Benefits

Conclusion:

A premier petrol points credit card can be a valuable tool for saving money on fuel purchases while earning rewards on your everyday spending. By understanding how these credit cards work and implementing strategies to maximize your rewards, you can enjoy significant savings at the pump. Whether you’re a frequent traveler or simply looking to stretch your budget further, consider adding a premier petrol points credit card to your wallet and start reaping the benefits today.