In today’s economy, everyone is looking for ways to save money and manage finances more effectively. One of the best tools for budget-conscious consumers is a credit card that combines top-tier benefits with no annual fee. This guide will explore the best and free credit cards available, detailing their benefits, features, and how to choose the right one for your financial needs.

Understanding the Appeal of Best and Free Credit Cards

Credit cards that offer significant benefits without an annual fee are an attractive option for many. They allow cardholders to enjoy rewards, cash back, and other perks without worrying about an extra cost eating into their savings.

Key Features of the Best and Free Credit Cards

The best no-annual-fee credit cards typically offer a combination of the following features:

- Cash Back Rewards: Many free credit cards provide cash back on everyday purchases like groceries, gas, and dining.

- Sign-Up Bonuses: Some cards feature attractive sign-up bonuses, which can be a great boost if you meet the spending requirements within the initial months.

- Introductory APR: Several cards offer 0% introductory APR for a set period on purchases and balance transfers, making them ideal for big purchases or consolidating debt.

Enhanced Security and Fraud Protection

Top no-annual-fee credit cards come with robust security features that protect users from fraudulent charges and identity theft, giving cardholders peace of mind.

How to Choose the Best and Free Credit Card

Choosing the right credit card without an annual fee depends on understanding your spending habits and financial goals. Here’s what to consider:

- Rewards Structure: Look for a card that rewards the categories where you spend the most.

- Introductory Offers: Evaluate whether the introductory APR or sign-up bonus offers are beneficial for your financial situation.

- Credit Requirements: Check the credit requirements for each card, as some may require good to excellent credit.

Best Practices for Using No-Annual-Fee Credit Cards

To make the most of these cards, it’s important to use them responsibly:

- Pay Balances in Full: Avoid interest charges and maintain a good credit score by paying off your balance each month.

- Maximize Rewards: Use your card for all applicable purchases to maximize cash back or reward points.

- Monitor Your Account: Regularly check your account for unauthorized transactions and to keep track of spending.

Top Picks for Best and Free Credit Cards

While there are numerous options on the market, some no-annual-fee credit cards stand out for their exceptional value:

- Chase Freedom Flex℠: Offers high cash back rates in rotating categories and a good sign-up bonus.

- Citi® Double Cash Card: Provides a flat rate of 2% cash back on all purchases—1% when you buy and another 1% as you pay for those purchases.

- Capital One Quicksilver Cash Rewards Credit Card: Features a simple cash back program and a competitive sign-up bonus with a low spending threshold.

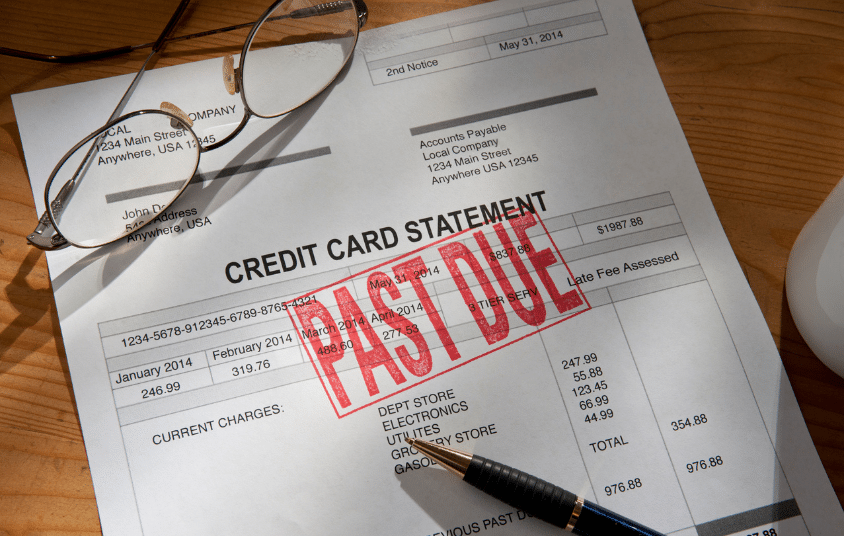

Also Read: Understanding Credit Card Statement Due Amount

Conclusion

The best and free credit cards offer a valuable opportunity to manage finances wisely without the burden of an annual fee. By choosing the right card and using it responsibly, you can enjoy a range of benefits and optimize your financial health. Whether you are looking to maximize rewards or minimize costs, there is a no-annual-fee card suited to your lifestyle and spending habits.

Frequently Asked Questions

What makes a credit card the best and free?

The best free credit cards combine significant rewards, no annual fee, and other benefits like low APRs and sign-up bonuses.

How can I qualify for a no-annual-fee credit card?

Generally, you need to have good credit to qualify for the best offers, although there are options available for those with lower credit scores.

Are there any downsides to using a no-annual-fee credit card?

While no-annual-fee cards offer great benefits, they may have higher APRs or fewer perks compared to premium cards with fees.