Credit cards provide its users several perks and benefits in addition to convenience in the modern world. Choosing the credit card with the best reward rates is essential for Indians who want to make the most of their benefits. Let’s explore some of the best choices on the Indian market.

Understanding Reward Rates

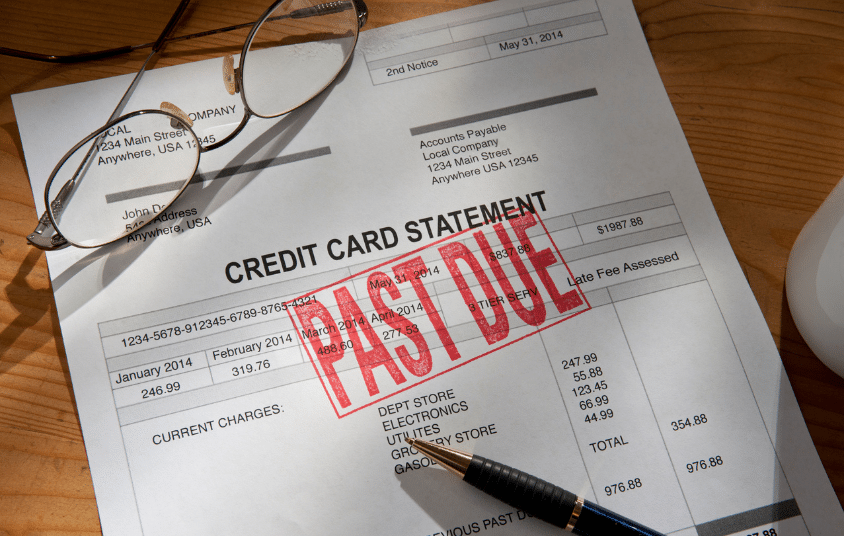

The percentage of rewards earned on each rupee spent with the credit card is referred to as the reward rate. These incentives can take many different forms, such as discounts on purchases, rebates, points, or miles. It’s important to take into account a variety of aspects when choosing a credit card, including annual fees, redemption choices, and extra benefits, in addition to the reward rate.

Best Reward Rate Credit Cards in India:

HDFC Bank Diners Club Black Credit Card:

Reward Rate: With this premium credit card, users can earn up to 5% cashback or reward points on every transaction, depending on the spending category.

Additional Benefits: Complimentary airport lounge access, travel and lifestyle benefits, and exclusive dining privileges.

SBI Card PRIME:

Reward Rate: This card offers attractive reward rates on various categories, including dining, groceries, and utility bill payments.

Additional Benefits: Welcome e-gift voucher, milestone rewards, and fuel surcharge waiver.

American Express Membership Rewards Credit Card:

Reward Rate: Users can earn Membership Rewards points on every transaction, which can be redeemed for a wide range of options, including travel bookings, gift vouchers, and statement credits.

Additional Benefits: Welcome gift, bonus points on renewal, and access to the American Express Invites program.

ICICI Bank Amazon Pay Credit Card:

Reward Rate: This co-branded credit card offers competitive reward rates, especially for Amazon purchases, along with benefits on other spending categories.

Additional Benefits: Cashback as Amazon Pay balance, no-cost EMI options, and fuel surcharge waiver.

Also Read: Are Credit Card Promotions Worth It? Pros and Cons

Conclusion:

The finest credit card with a reward rate in India would rely on personal preferences and spending patterns. There is a credit card that can be customised to meet your demands, regardless of whether you value travel advantages, cashback, or rewards points. You can maximise the rewards on your regular spending and make an informed decision by being aware of the rules, advantages, and reward rates associated with each card.